- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

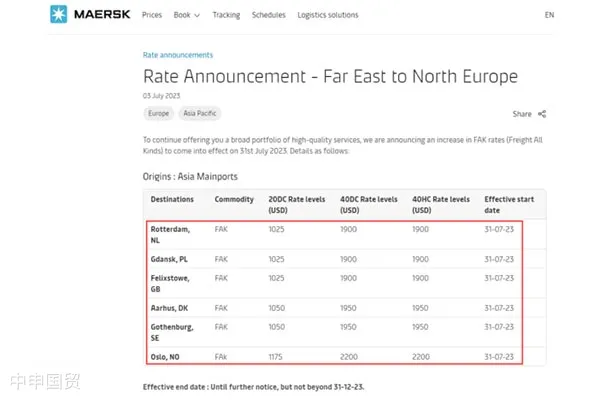

Recently, the container shipping market has shown overall weakness, driven by complex factors. According to the latest data from the Shanghai Shipping Exchange on June 30, the SCFI index rose 29.31 points to 953.6, a weekly increase of 3.17%. While U.S. route rates rose, European routes continued to decline. Against this backdrop, Maersk, the worlds largest container shipping company, announced an adjustment to its FAK rates for Far East-Northern Europe routes, effective July 31, 2023.

Maersks announcement states that FAK rates from major Asian ports to Northern European hubs like Rotterdam, Felixstowe, and Gdansk will increase to $1,025 per 20-foot container and $1,900 per 40-foot container. Rate erosion on this route has accelerated, with Xenetas XSI Asia-Northern Europe index showing a further 1.3% drop last week to $1,224 per 40-foot container, nearly halving since the start of the year.

However, despite the rate hike, Northern Europes market rates have plummeted below $1,000 per 40-foot container. Overcapacity persists, with carriers continuing to sell space at low prices to secure orders. Even during peak season, the expected rate recovery has not materialized.

Meanwhile, weak export demand from Asia to the U.S. and Europe, coupled with an influx of new ultra-large container ships on Asia-Northern Europe routes, has intensified supply pressures. Maersks shocking FAK rate hike will only take effect if vessel capacity is reduced. However, given Mediterranean Shipping Companys independent operations post-2M Alliance dissolution, capacity reductions are unlikely.

The container shipping market faces ongoing challenges, with Q2 already causing significant losses for carriers. Still, other companies may follow Maersks lead with similar rate hikes. This potential shift pressures shippers and forwarders to communicate with carriers and plan shipments carefully to avoid disruptions.

In summary, market volatility will persist, with rate adjustments, overcapacity, and vessel capacity changes shaping the future. Carriers, shippers, and forwarders must adapt to these challenges. For forwarders, anticipating rate changes and planning shipments will be key to maintaining competitiveness.

Related Recommendations

? 2025. All Rights Reserved. 滬ICP備2023007705號-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912